TAIPED and the Colpo Grosso of Kassiopi

It’s a story of the years of Memoranda. And the Memoranda of the Left for the first time. It did not start during SYRIZA government, but it did turn strange in its days. It concerns the iconic land of Kassiopi in Corfu, one of the “silverwares” which the State was called to sell in order to reduce the national debt. Initially, in 2012 – 2013, the TAIPED actualised an auction for the concession of the exploitation of the beautiful area of 490 acres on the northeast of the island for 99 years. The bidder was found and paid in 2016 the first instalment of the whole amount of 23 million Euros; there were also the usual complex groups via offshores from Cyprus to Cayman Islands. But then a second auction came. Without initially becoming widely known, in June 2017, the ownership of the above part of the property, where properties of 27,000 sqm may be built, was also auctioned. Typically, TAIPED appeared to invite anew the investment circles to re-bid for the full ownership of the buildable part of Kassiopi, a segment which will not be returned to the State after 99 years. Essentially, it was inviting the investors to bid for the purchase of an area which, as a subtotal of a larger plot, has already been pledged to a particular bidder for 99 years in a previous auction!

Who would give money today for something he will acquire after a century? Obviously, the only real “interested party” would be the bidder of the first auction, as – no surprise – happened. The fact that there will be a second auction – with the bidder of the first being in such favourable position – was not known when the privatisation of the Kassiopi area started in 2012. Did something change in 2017? Why? And for what benefit? Because the price is also an important issue. The only interested party paid a significantly lower price, for a buildable area of 27,000 sqm, than the price of those available in the wider Kassiopi area… Do you smell something?

A scent of scandal and a stack of questions

A scent of scandal and a stack of questions are raised with regard to the case of privatisation of the public property in Kassiopi, an area of particular natural beauty in the northeast of Corfu.

The case began in 2012, when an auction was materialized by TAIPED for its long-term lease – a right to surface, as it is called, to concede to the winner the exploitation of the area for 99 years and the return, afterwards, of the lands and the infrastructure to the State. Regarding this tender, which was completed under the ND-PASOK government in 2013, the projected revenue for the state treasuries amounts to 23 million Euros.

However, the privatisation of Kassiopi continued under SYRIZA in 2017, when the ownership of a segment of the property, where luxury housing could be built, was sold. The revenue from this tender was just over 2 million Euros. Those areas and infrastructure will not be returned to the State.

When the first tender was completed in 2013, TAIPED stated: “it is emphasised that the land remains in the possession of the Greek State as it will be exploited under the institution of surface”. Today, when asked by Protagon regarding the reason of the decision to sell the ownership of part of the property in 2017, TAIPED replied that: “the second tender was limited to the sale of segments of the property where houses will be built. This is a common practice followed in real estate development processes, where the part aiming at the building of residencies is offered to the investor with the right of ownership”.

Nonetheless, that practice was not known to the interesting parties from the beginning, as both press releases and the 2012 investor call did not mention anything relevant.

And that is not the only thing: areas adjacent to the State property, which were recently sold, according to our research, stood for 2.5 million Euros for 15 acres of land with 350 sqm of those being buildable. Whereas, though the sale of the ownership and the long-term lease of the State property in Kassiopi, the proceeds amounted to 25 million Euros for a property with 27,000 sqm being buildable and remaining under the ownership of the investor. That is, at least a six times lower price per buildable sqm.

Protagon asked TAIPED, if, within the framework of the tender of land sale in Kassiopi, a research was conducted concerning the commercial values of the adjacent properties. We did not receive an answer to this question.

When the TAIPED’s Board of Directors decided in secret

March 16, 2017. The Board of Directors of TAIPED is facing major decisions. During that day’s meeting, it was decided to terminate the tender for the sale of 66% of the shares of the National Gas System Operator (DESFA), after the approval by the Government’s Economic Policy Council, after the Azeri company SoCar had withdrawn from the proceedings, previous November, and the discussions with the remaining candidates had not met expectations. It was a process where, if completed, the estimates for the revenue brought to the State is about 400 – 500 million Euros and more.

At the same meeting, it was also decided that the restart of the procedures for the sale of DESFA, with the recruitment of a financial advisor to aid the planning and implementation of the new tender. Additionally, it was also decided that the commencement of the negotiation with the company named Greek Petroleum for the drawing up of a Memorandum of Understanding among the Greek State, TAIPED and ELPE for the joint sale of 66% of the shares via a new tender undertaken by TAIPED.

Among the above, it was decided to put up for sale a part of the State property, which has already been tendered for a 99-year long lease and exploitation by the bidder. The tender of the long-term lease has already been completed by 2013 and the winner was NCH Capital – a New York-based fund. At the time of the decision to sell the above part, the Board of Directors consisted of Antonis Leousis, Lila Tsitsogiannakopoulou and Angelos Vlachos.

The TAIPED’s announcement issued on the same day referred to the decisions on DESFA and ELPE – but not on the State property. The decision to sell the ownership of the property, which was made during that board session, became known three months afterwards, when the invitation to offer submissions by the potential buyers was released. The winner was once again the “sole bidder”, as announced in a press release by the privatisation agency: NCH Capital, which has already acquired the long-term exploitation of 99 years for 23 million Euros. The TAIPED’s decision for the further exploitation of the State property generated a final revenue of 2 million Euro. The only bidder has acquired ownership of an area – which will not be returned to the State after 99 years, as in the case of long-term leases – in one of the most beautiful areas of Greece, where he can build over 27,000 sqm of luxurious housing. Nonetheless, a few kilometres away from the site, 15 acres (i.e. 15,000 sqm) were recently sold for 2.5 million Euros with 350 sqm being buildable.

How could this have happened?

Let’s get things right from the beginning. In 2012, when the decision was made concerning the exploitation of the Erimitis area (that’s how it is called the specific part of Kassiopi), there was no mention concerning the sale of ownership of the area. The tender concerned the right to surface, i.e. the long-term exploitation of property for 99 years and afterwards its return to the State.

The State property, of a total of 490 acres, is situated in northeast Corfu. It is a link in the ecological chain which starts from the north-western part of Corfu, Lake Antinioti included in the Natura Network, and continues to the opposite continental shore, which Albania has declared a national park.

For the purposes of the first tender, the Erimitis property, at the beginning of 2012, went under the ownership of TAIPED which, in March of the same year, released the corresponding invitations for potential investors.

According to its invitation, TAIPED would concede to the winner of the tender the shares of the special purpose company to which it would transfer the “right to surface” of the State property in Erimitis for a period of 99 years. This special purpose company was named “New Corfu Real Estate Investments S.A.” based in Greece. By winning the shares, the winner of the tender would have been able to exploit the area for 99 years, investing in mild tourism development infrastructure and earning the corresponding profits. After 99 years, the property and any infrastructure that has been developed by the surface holder, that is, who has won the right to surface in the tender, returns to the State.

The first white smoke came out in early 2013. The TAIPED’s Board of Directors approved the concession contract of the property of Erimitis to the bidder – investor named NCH Capital, a fund based in New York and with many subsidiaries in the Cayman Islands. The surface acquisition price for 99 years amounted to 23 million Euros plus 2.3 million Euros for the potential contribution of TAIPED to the future value of the property. As mentioned in the press release, in late January 2013, NCH Capital’s investment in mild tourism development in the region was estimated at 75 million Euros and was expected to “create hundreds of new jobs” during the construction period. Out of the 490 acres, 438 were transferred to the bidder, while 320 acres would remain accessible to the public. The investor has the right to build around 36,000 sqm. “it is emphasised that the land remains in the ownership of the Greek State and the exploitation will be actualised under the institution of surface. NCH Capital is based in New York, USA, and manages USD 3.5 billion with a focus on real estate, primary sector production and private equity and operated 21 investment funds”, was mentioned in the press release.

Thus, TAIPED transferred the right to surface of the property to the special purpose company New Corfu Real Estate Investments S.A., the shares of which were transferred to the Cypriot company Nectar Holdings Limited. Shareholders of the latter are two funds of NCH Capital which participated in the tender: the NCH Europe Fund II LP and the NCH Balkan Fund LP – both based in the Cayman Islands.

But why all this chain of companies from Cayman to Cyprus for the transfer of property rights? This may have something to do with tax rates. In Cyprus, a company’s income is taxed at 12.5% and the Cayman at 0%. So, when the profits from the Greek Investment are distributed to the investors, the latter have less taxes than if their companies were based in countries with higher tax rates.

Reactions in Corfu

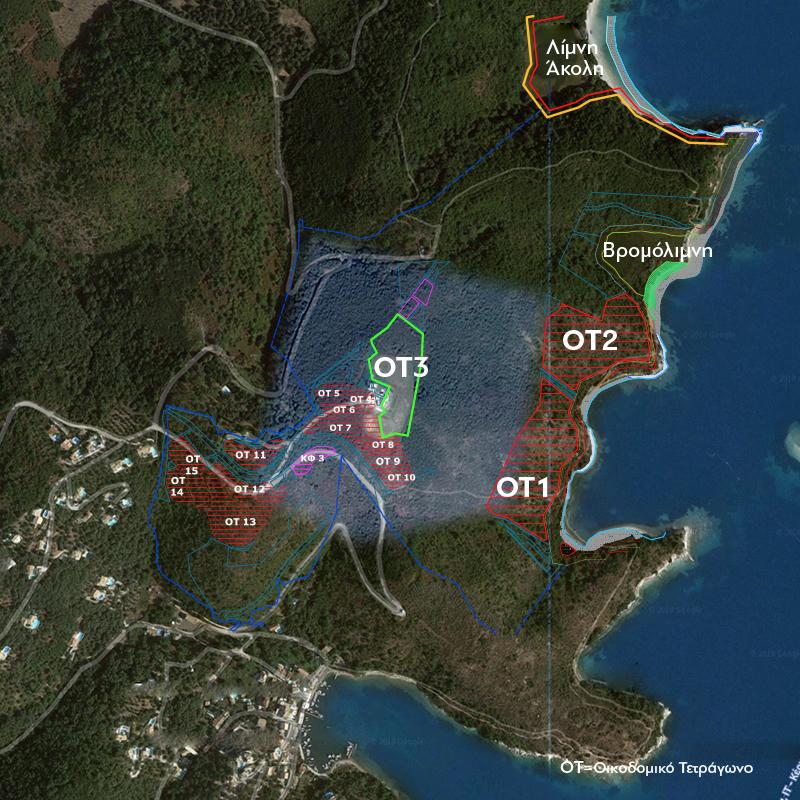

Local groups of citizens, municipal and regional factors as well as environmental organisations reacted to this sale. When the Presidential Decree approved the development plan of the property, which provided for the construction of 36.5 acres (36,500 sqm) out of which 7 acres (7,000 sqm) concerned the construction of a hotel unit, appealed to the Council of State requesting the annulment of the decree – a request which was rejected. The same was repeated with the approval of the town planning study, in which the urban and buildable area was divided into 15 building blocks, of which the construction of a hotel was permitted in number 3.

At the end of 2016, TAIPED issued a press release entitled “The privatisation of Kassiopi, Corfu was completed”, announcing the payment of the first instalment of 10 million Euros, out of a total of 23 million Euros, whereas after three months, its Board of Directors decided for the further exploitation of the property, by the land sale of the building blocks other than the one where the hotel is allowed to be built. In June 2017, the relevant Invitation to Tender of Offers for Land Ownership was also published. Namely, TAIPED has invited investors to buy land, the exploitation of which has been already acquired for 99 years, via the New Corfu Real Estate Investments S.A., by the Cypriot Company Nectar Holdings, with shareholders being two funds in the Cayman Islands owned by NCH Capital.

As expected, the tender was won by the “sole bidder” – as mentioned by the press release by TAIPED – New Corfu Real Estate Investments S.A. owned by NCH Capital. But what doesn’t sound quite normal is the price: the 27,000 sqm were sold for 2,050,000 Euros. This sale was approved by the Court of Auditors in November 2017.

After the sale of the ownership, the properties are not returned. And here’s the question: what other potential investor would have taken part in a tender for a property sale, the exploitation entitlement of which has been possessed by someone else for 99 years? Who would wait a century to take advantage of something they buy today?

We asked the experts – what they told us

Protagon turned to experts asking them to analyse the data and find the amount needed to pay for building in three cases, that of Erimitis and two adjacent private properties which were sold quite recently.

Concerning Erimitis: The surface and the ownership entitlements required 25.05 million Euros. The surface that can be built is 34,150 sqm including the hotel of 7,020 sqm. Due to the fact that the hotel’s building block was not included in the 2017 tender for the sale of the ownership, the surface that can be built and retained by the owner amounts to 27,120 sqm (together with the buildings, namely, the luxury residencies, as provided in relevant studies). This means that for every square metre that can be built, a little over 923 Euros are paid. If the area of 7 acres of the hotel is included, then the cost falls to 733 Euros.

In the case of the first adjacent property with surface of 15 acres, sold for 2.5 million Euros, the facts are quite different. In accordance with the regulations, 350 sqm can be built on these 15 acres. Which means that almost 6,850 Euros are paid for each square metre – a price six times higher than that of the Erimitis case.

With regard to the second adjacent property, with a forest area of 390 acres and 12.4 buildable acres which was sold against 5.7 million Euros, there are two cases: the first is the building of a house of no more than 325 sqm, according to regulations, the cost of each square metre can be set at 17,500 Euros, taking into account the total price also for the forest area. The second concerns the utilisation of predictions for the construction of a hotel unit, which should not exceed 2,480 sqm. In this case, the cost per square metre be built is 2,300 Euros – much more expensive than the Erimitis case.

| Kassiopi at a glance |

| Cost of building “air”

There are distinctive differences with regard to the money that the investor of the State property of Kassiopi paid for every square metre of luxury housing that may be built, compared to the owners of real estate in the wider area. Based on the price against which the State property was conceded to the investor, each square metre costs at least six times lower than the corresponding prices that the owners of the adjacent properties paid. |

| State Property of Kassiopi |

| 1st transaction (2013)

EUR 23 million for the long-term lease for 99 years (“right to surface”, as it is called) of the property of 490 acres. 34,150 sqm are buildable (luxurious residencies and hotel), the exploitation of which belongs to the investor for 99 years. Afterwards, the area and the infrastructure will be returned to the State. |

| 2nd transaction (2017)

EUR 2.05 for the purchase of the ownership of the buildable areas where luxurious residencies may be built. 27,120 sqm, of luxurious residencies on which the investor can built, will stay under his ownership, even been sold, due to the fact that he is not required to return the land and the constructions to the State after 99 years. |

| Total

EUR 25.05 million, The revenue for the State by the long-term lease and the sale of ownership of part of the property. |

| Property adjacent to Kassiopi

(recent sale of 15 acres among private individuals) EUR 2.4 million, the price of the purchase 350 sqm are buildable |

| The Comparison

State property of Kassiopi 25.05 million / 27,120 sqm = 923.63 EUR (the cost of the building “air” per sqm) |

| Adjacent property to Kassiopi

2.4 million / 350 sqm = 6,847.17 EUR (the cost of the building “air” per sqm) |

There are also the ads for sale in Corfu. A simple internet search shows that the price of properties that may be built “in a luxurious fashion” and are situated near the beach range between 70 Euros and 200 Euros per square metre in order that someone acquires the corresponding ownership. In the Erimitis case, where the ownership of 74 acres (this almost equals the area of building blocks that 27,120 sqm may be built) was purchased for 2.05 million Euros – without calculating the right to surface – the prices go up to 30 Euros per sqm.

We asked TAIPED – what we were told

Protagon asked questions to TAIPED regarding the privatisation of Erimitis.

Question 1: With regard to the question of whether it was considered possible to attract investors other than the surface owner for the acquisition of the ownership entitlement, while the surface owner possess the exploitation rights of the area for 99 years and had a pre-emptive right – namely, in cases of similar offers among the potential buyers the surface owner would win again – we got the answer:

“TAIPED always conducts international, open tenders in accordance with strict rules of transparency and equal treatment of the interested parties, which is confirmed by the Court of Auditors approval of each tender procedure. The latter approved the signing of the relevant contracts. The openness of the bidding process has been substantiated by the participation of another foreign investment scheme, which obtained the relevant information material”.

However, a press release issued by TAIPED, in November 2017, does not refer to the participation of another foreign group in the bidding process but to a “sole bidder”. According to the press release: “The Board of Directors of TAIPED has accepted the improved offer of the sole bidder, “New Corfu Real Estate Investments S.A.”, of 2,050,000.00 Euros and it proceeded with the award of the tender”.

Question 2. TAIPED was also asked if its management is satisfied with the acquisition of ownership rights worth 2.05 million Euros. The former replied: “For the purposes of the tender, an independent valuation was carried out, as is the case with any Fund’s bidding process, to ensure that the value of each transaction is fair and reasonable. It is emphasised that the submitted offer exceeded that evaluation and took place due to pressure of TAIPED for an improved bid”.

Question 3. Has any research been carried out – in the context of the tender for the concession of the ownership entitlement – in adjacent areas so that an accurate estimation for the commercial values of the adjacent areas for sale would take place?

We did not receive a reply.

Question 4. With regard to the question addressed to TAIPED concerning the reason of the decision of the 2017 tender for the concession of the ownership entitlement of 15 building blocks totalling up to a buildable surface of 27,100 sqm, TAIPED replied:

“The exploitation of the right to surface and the right to ownership have been the subject of two separate tendering procedures. The first took place in 2012 – 2013 and concerned the disposal of the right to surface over the property. The second tender was limited to the sale of parts of the property where residencies will be built. This is a practice followed in real estate development processes, where the investor’s ownership is traditionally reserved in the residential segment”.

The Conclusion

The exploitation of Erimitis began as a concession of the right to surface for 99 years. The original offer for expression of interest did not mention anything about the subsequent sale of the land’s ownership. All that is stated in the Law for the establishment and responsibilities of TAIPED is that, with regard to the right to surface, “conditions may be included referring to the right of the surface owner to acquire the land as well”. However, in this particular case we have a new tender for the sale of the land’s ownership, in which someone already had the right to surface.

Therefore, it is not unreasonable to assume that if TAIPED had announced, since the first tender, its intention to follow this “practice”, as it describes it, that is to eventually sell the land rather than simply granting the right to surface of the land where luxurious residencies would be built, both the investor circle and the price would be different. And the revenue for the State would possibly be higher.

However, such “practice” was not mentioned in the press release for the first tender in 2013: “it is emphasised that the land remains in the ownership of the Greek State as it will be exploited based on the institution of surface”, was assured by the TAIPED’s Board of Directors of that time.

The above continued in 2017, when the lion’s share of the building blocks was sold, it was natural that no one would be attracted other than the one who had acquired the right to surface… Why would any reasonable investor buy land where he could not do anything until the next century?

Πηγή: http://www.protagon.gr/themata/taiped-kai-colpo-grosso-tis-kassiopis-44341637063